It is not uncommon to see a large number of people using spreadsheets in their work. As a matter of fact this tool can be of great help to speed calculations, explore models and even visualise data. Their use is common in a number of areas and economics and finance is no exception. Take a look for instance at this reference page on The Economics Network. I personally see nothing wrong with using them, but I have always said that just because Excel, Numbers or Calc returns a figure, it does not mean that the calculations are necessarily correct.

And the consequences of a faux pas in the use (or misuse) of spreadsheets is nowhere clearer than in the recent Reinhart and Rogoff debacle. The two Harvard economists have worked in senior positions at the International Monetary Fund and are indeed at the top of their profession. In 2010 the two economists presented a paper entitled “Growth in a Time of Debt” in which the researchers found that economic growth was notably lower when the gross public debt of a country is greater or equal to 90% of its GPD… This figure became the argument politicians started using in austerity discussions: The study has been cited for instance by Paul Ryan, a US congressman, in his 2013 budget; as well as by Ollie Rehn, the EU Economic and Monetary Affairs Commissioner. All this is well and good, except for the fact that there were some errors in the spreadsheet used in their calculations. The errors have been reported to be “coding errors” which make it sound far more complicated than it may be… It seems that five countries in their sample were completely excluded from the calculations…

The errors came to light thanks to the work of Thomas Herndon, Michael Ash and Robert Pollin from the University of Massachusetts, who tried to replicate the original results. You can find their paper here. The UMass researchers criticise the Harvard economists’ work in three areas:

- Spreadsheet errors – five countries were excluded completely from the sample resulting in significant error of the average real GDP growth and the debt/GDP ratio in several categories.

- Selective exclusion of data – Australia (1946-1950), New Zealand (1946-1949) and Canada (1946-1950).

- Unconventional weighting of summary statistics – equal weight by country were used rather than by country-year.

This means that the Reinhart-Rogoff results understate the average growth at high debt levels. They do find indeed that high levels of debt are still correlated with lower growth, but the dramatic results of Reinhart and Rogoff disappear.

An account of how the error was found has appeared in the BBC news website and it is worth reading. This was possible because the UMass researchers had the temerity of requesting the original data to Reinhart and Rogoff. I would like to think that this whole episode could have been averted (and austerity programmes slowed) if the data had been made openly available from the start.

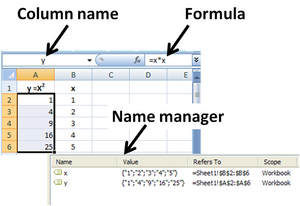

Now, back to spreadsheets… Given the availability of software such as Excel, we really, really should be weary of those instances where we enter formulas and mindlessly highlight cells to be processed by the spreadsheet.

Related articles

- Is the evidence for austerity based on an Excel spreadsheet error? (washingtonpost.com)

- Memo to Reinhart and Rogoff: I think it’s best to admit your errors and go on from there (andrewgelman.com)

- The mysterious powers of Microsoft Excel (bbc.co.uk)

- Austerity economics only works if you make an Excel formula error (boingboing.net)